High-Income Realty Spending: Optimizing Profitability

Purchasing high-income realty can be a financially rewarding approach for building wealth and generating passive income. Whether you're taking a look at high-end residential properties, multi-family devices, or commercial real estate, high-income residential properties provide consistent cash flow and lasting appreciation.

Why Buy High-Income Property?

Constant Capital-- Rental earnings from high-value residential properties makes sure monetary stability.

Appreciation Possible-- Prime property places often see considerable value growth with time.

Tax Benefits-- Capitalists can capitalize on devaluation, home loan interest reductions, and other tax obligation rewards.

Portfolio Diversity-- Purchasing high-income homes decreases threat and improves long-term economic safety and security.

Strong Need-- Luxury services, holiday residential or commercial properties, and business areas remain in high need.

Types of High-Income Realty Investments

1. High-end Residential Feature

Upscale apartments, penthouses, and single-family homes in prime areas attract high-income lessees willing to pay premium leas.

2. Multi-Family Units

Purchasing duplexes, triplexes, or apartment offers multiple earnings streams from a solitary financial investment.

3. Commercial Realty

Office, retail facilities, and industrial homes create high https://greenspringscapitalgroup.com rental returns and lasting leases.

4. Short-Term & Trip Rentals

High-end vacation homes in visitor locations provide high occupancy rates and premium pricing during peak seasons.

5. REITs & Real Estate Syndications

For financiers who like a hands-off technique, Property Investment Company (REITs) and submissions supply high-income possibilities without direct residential or commercial property administration obligations.

Trick Strategies for Success in High-Income Real Estate

Place Issues-- Select prime locations with strong task markets https://greenspringscapitalgroup.com/available-properties/ and preferable features.

Take Advantage Of Funding-- Use wise financing options to take full advantage of returns without exhausting capital.

Maximize Rental Earnings-- Remodel, furnish, or rearrange buildings to bring in high-paying lessees.

Effective Residential Property Administration-- Make certain expert upkeep and lessee satisfaction for lasting productivity.

Market Trends & Economic Variables-- Keep informed regarding market problems, interest rates, and economic fads that affect realty.

Challenges & Considerations

High Initial Financial Investment-- Deluxe and high-income properties often call for substantial resources.

Market Changes-- Economic downturns can impact building worths and rental need.

Home Maintenance Prices-- Maintaining high-end residential or commercial properties in top problem can be costly.

Renter Turn Over & Administration-- Finding and retaining top quality renters requires reliable administration strategies.

High-income property investing offers considerable financial incentives when approached with the right approaches. By focusing on prime locations, enhancing rental income, and leveraging tax benefits, capitalists can achieve solid cash flow and lasting riches development. Whether purchasing luxury houses, commercial areas, or short-term services, high-income real estate continues to be one of one of the most dependable courses to financial liberty.

Scott Baio Then & Now!

Scott Baio Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Amanda Bearse Then & Now!

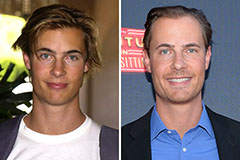

Amanda Bearse Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!